An investment that’s as safe as it is profitable !

Even though the past is not a guarantee of the future, as all financial

advisors will cautiously remind you, market figures show that purchasing

a house is a profitable investment on the medium and long term. From

$128,630 in 2002, the average price for a house on the resale market in

Québec has increased to $271,000 in the first semester of 2012.

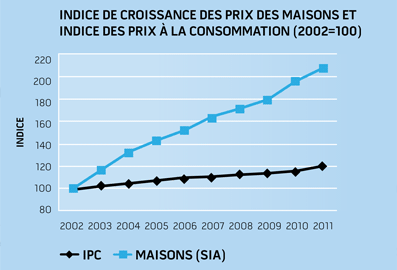

It’s simple, the yearly price increase for homes sold in Québec in the last ten years was close

to 8.2%. Considering that buying a home is both an investment and an essential asset with

minimum risks, it is useful to compare it to investments presenting the same level of risk. For

example, if we look at the average yearly return of Canadian Government bonds, we see that, at

maturity, their yield was 4.3% over the same period.

The progressive increase in real estate value that has been recorded over the years makes the

purchase of a home an investment that remains both safe and profitable – a rare occurrence

nowadays – given that it offers a greater return than comparable investments. Furthermore,

buying a home can be considered a good way to save money and diversify one’s assets.

Indeed, on one hand, money invested in real estate is not spent elsewhere, for example

on consumer goods that lose their value over time; and, on the other hand, it becomes

an excellent way to manage your “nest eggs” by putting them in “a different basket”.

Everyone knows that the best financial protection consists in keeping assets in different

types of investments for which there is little correlation in returns. This diversification

ensures more regular profits and protection against losses resulting from dips in certain

markets. Those who invested in real estate in the past ten years were well inspired given that

existing house values have gone up while returns on debt securities remained extremely low.

Safer than the stock market or gold!

On the stock market, despite greater risks associated with owning shares, the returns recorded

by the Dow Jones were practically nil during the past 10 years. As well, most will agree that the

current global economic situation is difficult to follow! For example, gold prices, traditionally the

hedge against inflation par excellence, may fall as fast as they rose. The value of your property

is much less volatile.

So, purchasing a home is more than a lifestyle choice: it is a wise investment that offers a

healthy diversification of your assets. Has any generation ever complained about the increase

in the value of their homes and of the personal and family wealth that resulted? In 2012, as was

the case in the past, it is without a doubt a type of investment that fits into a well-balanced

financial portfolio. Not to mention that you don’t pay taxes on the capital gain when reselling a

principal residence.

1 Based on the MLS (Multiple Listing Service) data on the average price on the resale market in Québec

Source: Association provinciale des constructeurs d’habitations du Québec (APCHQ)